Philippine Tax 2025. Annual information return of creditable income taxes. The philippines tax calculator includes tax.

How to pay tax online in the philippines in 2025: This 2025 tax calendar is designed to help you meet your tax obligations and to keep track of important tax dates during the year.

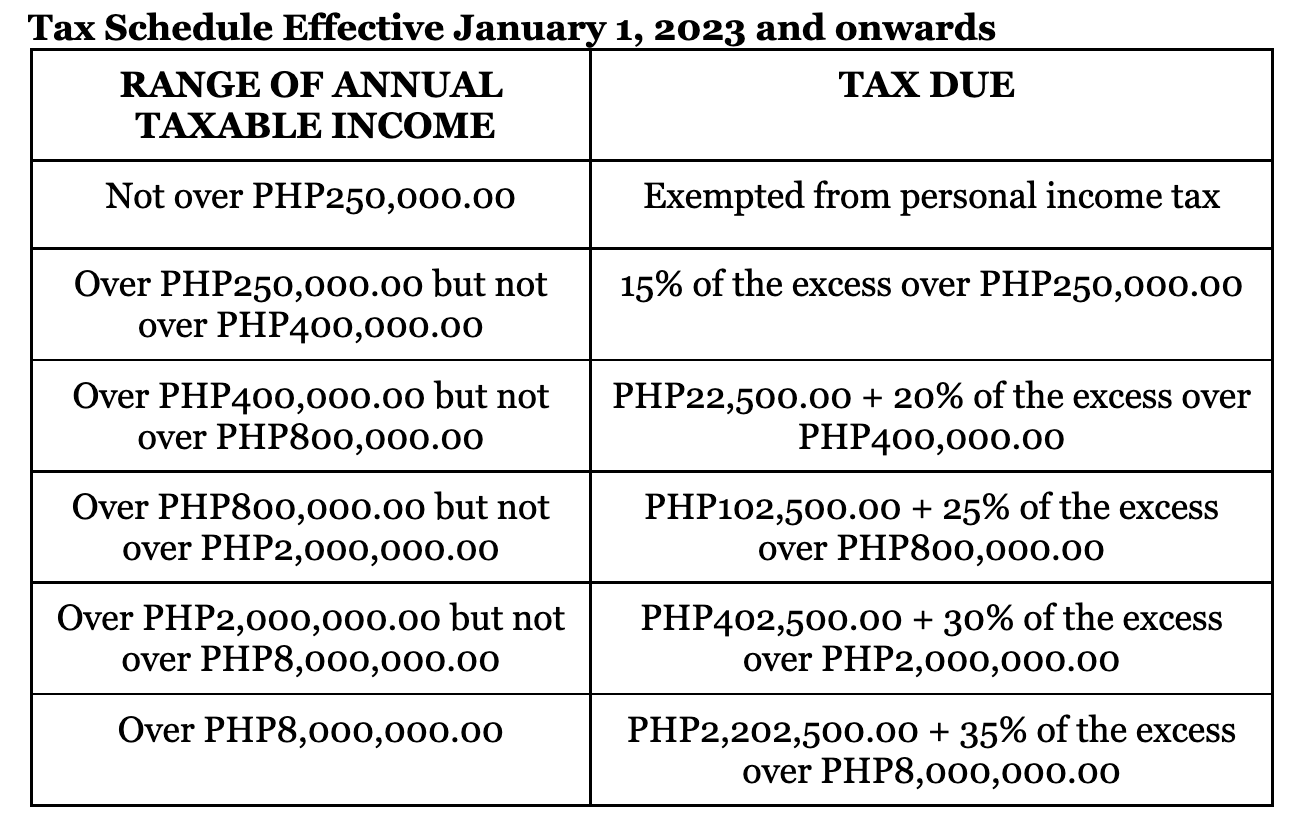

This means that those with higher incomes than php 8,000,000.00 will pay tax at a rate ranging between 15% to 30%.

When Will I Get My Tax Refund 2025 Canada Adore Mariska, How to use bir tax calculator 2025. Determining monthly income tax deductions effortlessly.

Tax Table 2025 Philippines Latest News Update, How to compute income tax in the philippines in 2025 (complete guide) step 1: Also see sample computations of income tax.

How To Compute Tax In The Philippines Free Calculator APAC, Navigate the philippines' tax landscape with our guide. Also see sample computations of income tax.

BIR Tax Schedule Effective January 1 2025, Bir form 2316 (certificates of compensation payment/tax withheld) february 28, 2025: This means that those with higher incomes than php 8,000,000.00 will pay tax at a rate ranging between 15% to 30%.

January 2064 Calendar Philippines, A quick and efficient way to compare annual. This means that those with higher incomes than php 8,000,000.00 will pay tax at a rate ranging between 15% to 30%.

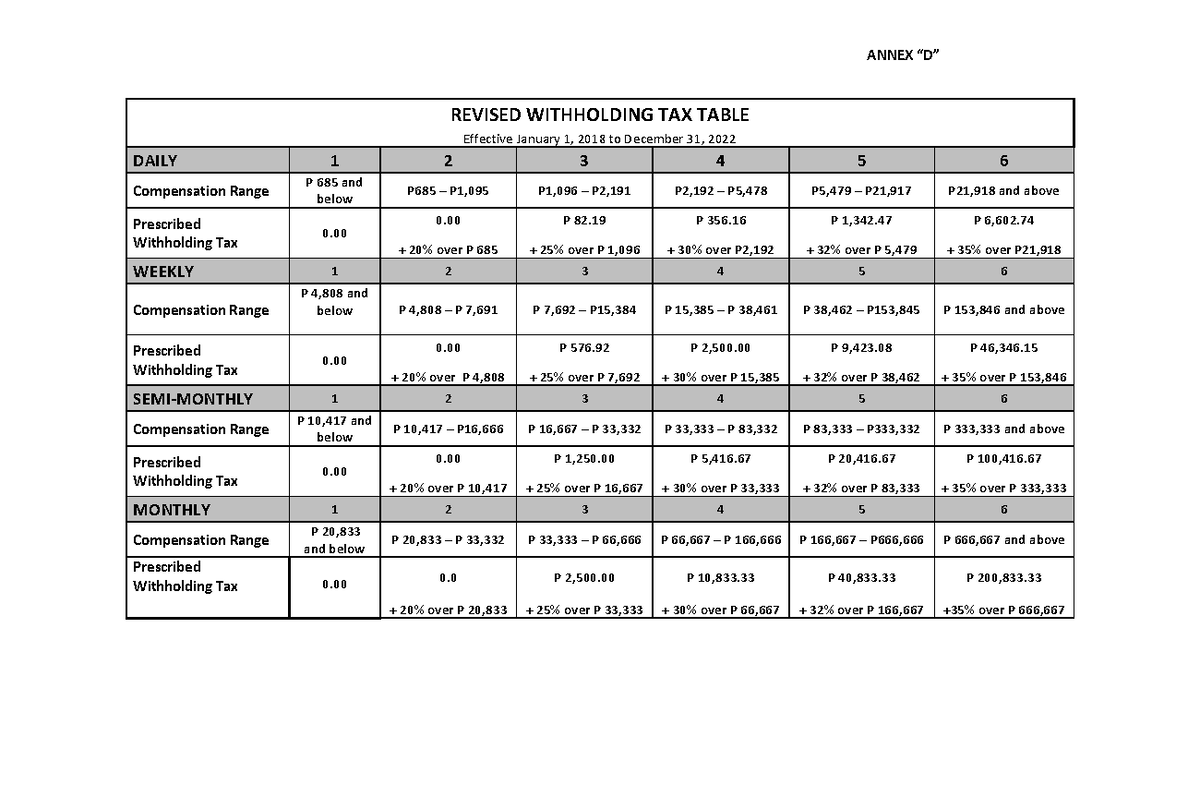

RR112018 AnnexD RevisedWithholdingTaxTable 20182022 (Philippines, A quick and efficient way to compare annual. Philippines personal income tax tables in 2025.

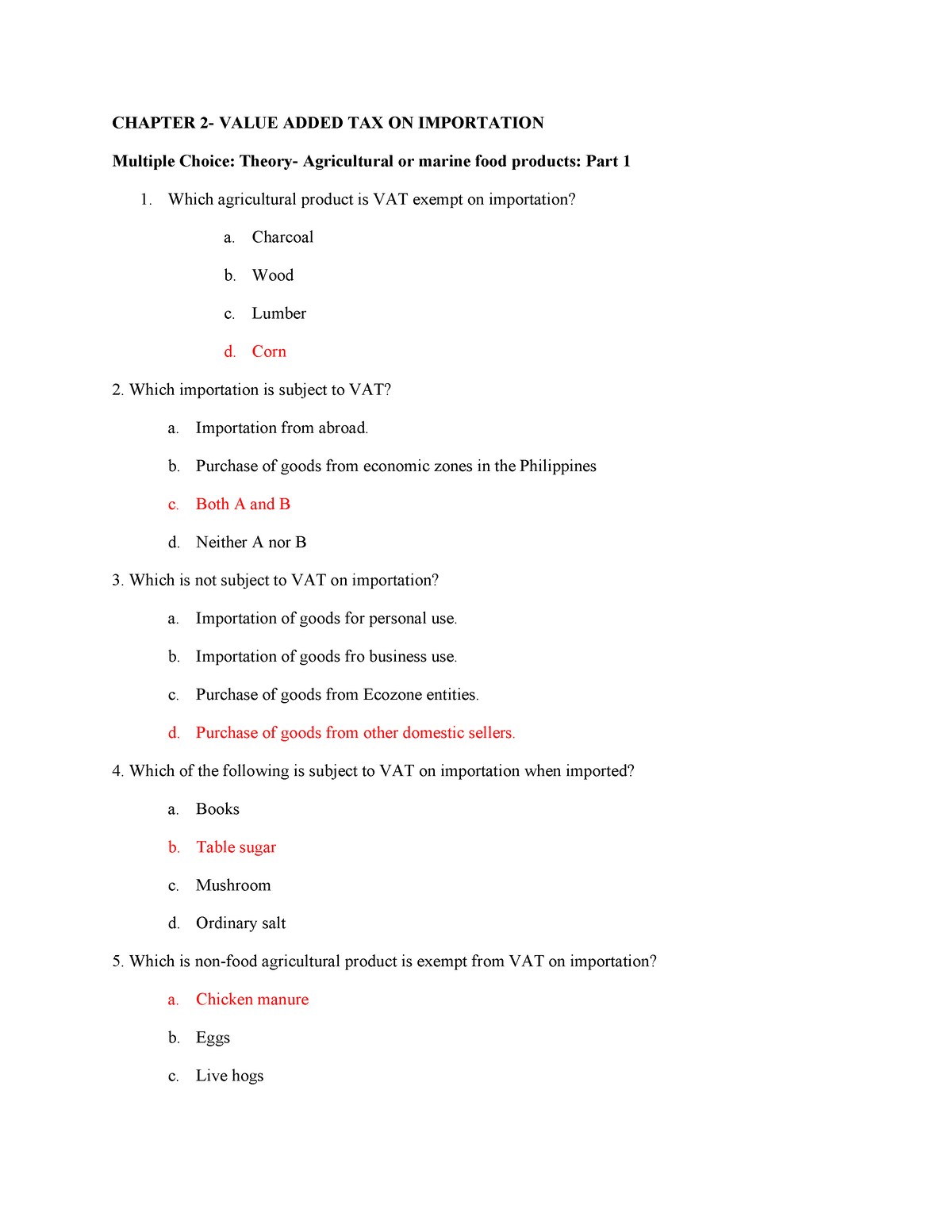

Chapter 2 Transfer and Business taxation Philippine Tax System and, Figuring out your net pay after tax deductions for. The income tax rates and personal allowances in philippines are updated annually with new tax tables published for.

RB20221010 New BIR Tax Tables Effective January 1, 2025 Titanium, Navigate the philippines' tax landscape with our guide. The salary tax calculator for philippines income tax calculations.

Tax Withholding Table The Treasury Department Just Released, How to pay tax online in the philippines in 2025: The salary tax calculator for philippines income tax calculations.

Philippine 100 Peso Bill, Philippines Money Currency, Philippine Money, A comprehensive suite of free income tax calculators for philippines, each tailored to a specific tax year. You’ll find that travel tax rates in the philippines vary, with specific categories of passengers eligible for different rates or exemptions.